ASO School

You can learn about ASO, App marketing, app store optimization and app promotional strategies here and gain the latest app market news and analysis. Helping you to carry out app store optimization and promote app data growth.

Eight Complete Steps for ASO Competitor Analysis: Teach You How to Thoroughly Develop Competitor Optimization Strategies

2026-01-14

Meta description:This article breaks down the 8 core steps of ASO competitive product analysis, from identifying target competitors to dynamic monitoring. It shows you how to unlock the key to keyword traffic, optimize metadata, achieve dual improvements in keyword coverage and download volume, and build a tailored ASO optimization strategy.

In today’s fiercely competitive mobile app market, more than 60% of users discover their favorite apps by searching in app stores, making ASO (App Store Optimization) a core driver of app growth. At the same time, ASO competitor analysis is the key to breaking through growth bottlenecks—if you don’t understand your competitors’ optimization strategies, you’re essentially groping in the dark. Many developers pour tremendous effort into ASO yet still fail to improve their keyword rankings or increase downloads. The root cause lies in their lack of a systematic approach to competitor analysis, leaving them unable to identify their own optimization gaps. In this article, we’ll break down 8 complete steps for ASO competitor analysis—from precise benchmarking to actionable execution—showcasing how to turn competitors’ strengths into your own growth engine and truly master ASO competitor optimization strategies.

Why is ASO competitive app analysis a must-take course for app growth?

Against the backdrop of continuously iterating app store algorithms and increasingly scarce user attention, isolated ASO optimization has long since lost its effectiveness. The value of ASO competitor analysis lies in enabling you to stand on the shoulders of industry benchmarks, avoid detours, and focus your efforts with precision—specifically in three core dimensions:

-

Unlock the secrets of traffic: The high-Ratings keywords and metadata layout of competing products are all “proven best practices” validated by the market. By analyzing these, you can quickly expand your own keyword library, enhancing both the breadth and precision of your keyword coverage.

-

Identify differentiation opportunities: By analyzing negative Reviews and functional shortcomings of competing products, capture unmet market demands to guide product iteration and optimize ASO creatives.

-

Agile response to market changes: Monitor competitors’ ASO strategy adjustments in real time—such as metadata updates and creative optimizations—to prevent rivals from seizing prime traffic positions and to maintain competitive edge in the market.

Systematic competitor analysis enables your ASO optimization to shift from “gut feeling” to “data-driven,” which is the core prerequisite for improving keyword rankings and driving download growth. However, many people’s keyword pools fail to deliver tangible results because they “collect without filtering.” If you’re facing this very challenge, consider leveraging professional expertise to break the deadlock efficiently.

Consult NowAppFast Business, claim your custom APP keyword library for free. We’ll leverage high-value competitor keywords and your product’s core strengths to distill golden keywords that truly drive traffic, helping you boost your download numbers.

8 Complete Steps for ASO Competitor Analysis: A Step-by-Step Guide to Implementation

Step 1: Precisely Target to Find Your “Real Competitors”

The first step in conducting competitive analysis is to avoid “misalignment”—if you choose the wrong benchmark, all subsequent work will go off track. Based on your product positioning, you need to categorize competitors into two types and follow scientific selection principles:

-

Direct competitors: Apps with highly similar features and completely overlapping user groups—for example, your fitness app competing with Keep, or your note-taking app competing with Notion. These types of competitors are the core of your analysis and directly determine the direction of your ASO optimization.

-

Indirect competitors: Apps that address the same user needs but use different implementation approaches—for example, food delivery apps vs. recipe apps. These types of competitors can help you uncover cross-industry traffic opportunities and untapped user needs.

Core Screening Principles:

-

Prioritize competitor products that are similar in scale and stage of development, and that excel in core keyword rankings and top-position performance, while avoiding blindly benchmarking against industry giants.

-

Establish a dynamic monitoring list, incorporating 5 to 10 core competitors, and continuously update it based on market changes going forward.

Step 2: Gold Rush for Keywords – Decoding the Traffic Core of Competitor Products

Keywords are the “lifeline” of ASO. The high-ranking keyword layout of competing products is a traffic code we can directly draw upon. The core of this step is to deconstruct the competitor’s keyword strategy and uncover high-value “golden keywords.” The specific steps are divided into three points:

-

Metadata Dissection: Analyze each competitor’s app name, subtitle, and app description one by one, recording the placement and combination of their core keywords, with a particular focus on optimization techniques such as “front-loading core keywords.”

-

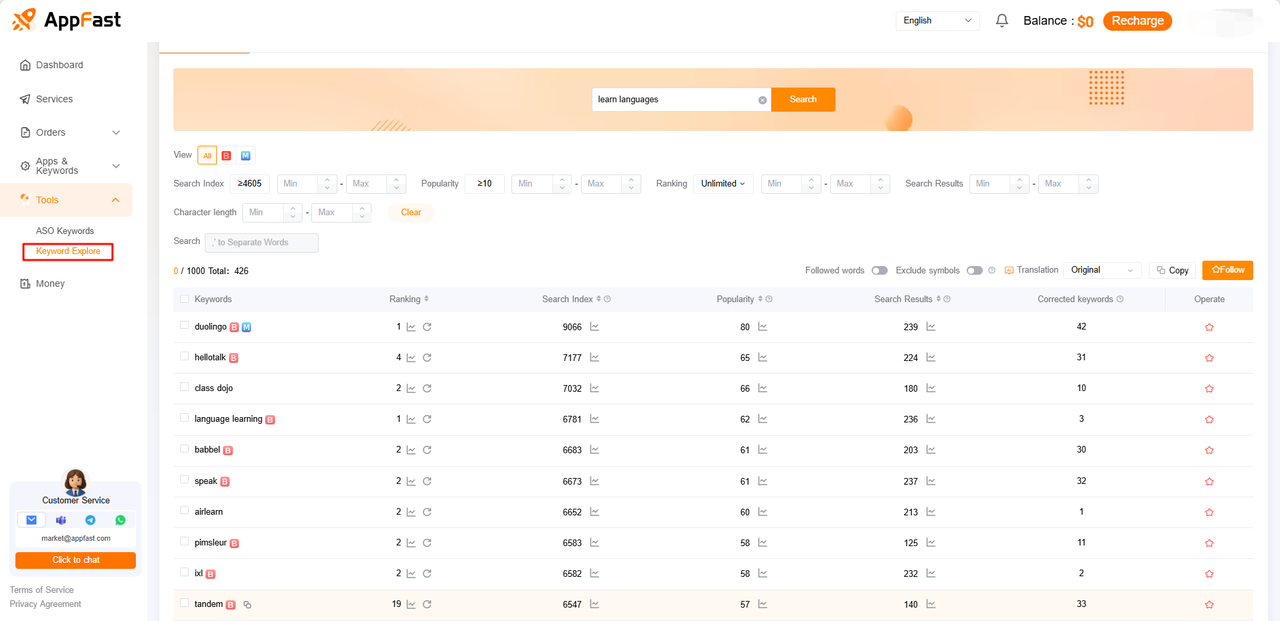

Ranking Scouting: With the help of the ASO tool AppFast, monitor the total number of keyword coverages for competing apps and the Top 10/Top 30 lists of high-ranking keywords, and filter out keywords that are “high search volume, low competition, and highly relevant.”

-

Keyword library expansion: Based on the keyword layout of competing products and leveraging AppFast’s word-expansion tool with “core keywords,” generate long-tail keywords.

The ultimate goal of this step is to compile a personalized list of golden keywords, laying the foundation for subsequent metadata optimization.

Step 3: Visual Decomposition – Analyze Competitors’ Techniques for Boosting Conversions

If keywords determine “whether users can find you,” then visual assets determine “whether users will download you.” The icons, screenshots, and promotional videos of competing products are all conversion powerhouses that have undergone repeated testing. We need to deconstruct and analyze them from three dimensions:

-

App icon: Observe the color combinations and core element design of competing app icons to determine whether they align with the target users’ aesthetic preferences and whether they can quickly grab attention in the app store listings. For example, tool-type app icons often use simple, functional symbols, while social networking apps place greater emphasis on the appeal of their colors.

-

App Screenshot: Focus on analyzing the logical structure of the screenshot content—whether it follows the sequence of “pain point → solution → results,” whether the copy is concise and directly addresses user needs, and whether it showcases real-life usage scenarios.

-

Promotional video: Check whether the first 3 seconds of the video grab attention, whether the core features are clearly explained within 15–30 seconds, and whether the video is optimized for silent playback.

After the analysis is complete, summarize the excellent design insights from competing products, and based on your own product’s characteristics, develop a plan for asset optimization and A/B testing.

Step 4: Users listen in and unearth valuable insights while avoiding pitfalls from Reviews.

User Reviews are the product’s “real-life health report” and also an important basis for ASO optimization. By analyzing the Ratings and Reviews of competing products, we can accurately grasp users’ core needs and pain points. The specific process involves two steps:

-

Positive Ratings Analysis: Extract high-frequency words from five-star positive Reviews, such as “no ads,” “easy to use,” and “practical features.” These are value points that users recognize and can be incorporated into your own app description and creative copy.

-

Negative Ratings Analysis: Sort out the core pain points from low-star Ratings, such as “frequent crashes,” “opaque automatic subscription renewals,” or “lack of key features (such as offline mode).” These pain points represent critical opportunities to define your unique differentiating advantages. For example, if you find that users in the market are universal complaining about “complex and lengthy operation processes,” you can distill “complete core tasks in three quick steps” or “ultra-simplified workflow design” into a core selling point. Then, focus on incorporating this into your subtitle and screenshot copy to directly address user needs.

Step 5: Data Insights – Estimate Competitors’ Download Volumes and Growth Trends

Understanding the market size and growth trends of competing products can help us set reasonable ASO goals and determine whether their growth is driven by organic traffic or paid promotion. Specific analysis methods include:

-

Ranking Trend Monitoring: Track changes in competing products’ rankings in the app store’s free chart and top grossing chart, and combine this with the growth rate of Reviews to determine their lifecycle stage (growth phase, plateau phase, decline phase).

-

Data tools assistance: With the help ofASO ToolsThe platform’s download volume estimation feature helps you understand the average daily download volume and revenue scale of competing products, compare these metrics with your own performance, and identify breakthroughs for growth.

-

Traffic Source Identification: If a competitor’s Rankings suddenly surge while its metadata remains unchanged, it’s highly likely that the competitor has invested in paid promotion. If the Rankings rise steadily and the keyword coverage continues to expand, it indicates that the competitor’s ASO optimization is delivering significant results.

Step 6: Conduct real-world testing to compare the strengths and weaknesses of the product’s UX against competing products.

The core goal of ASO is “acquiring users,” while the product’s user experience (UX) determines “retaining users.” Only by personally experiencing competing products can you truly understand their core strengths, identify gaps in your own product and ASO optimization, and evaluate specific experience dimensions, including:

-

Smooth operation: Test the loading speed and operation steps of core features to determine whether there are issues such as lagging or crashes.

-

Intuitive interface: Evaluate whether the navigation design is clear, whether new users can quickly get started, and whether core functions are easy to find.

-

Perceived Value: Determine whether users can perceive the core value of the product within 30 seconds; this also serves as a key basis for us to optimize the app description and creatives.

After completing the experience, create a competitive product experience comparison table and prioritize your own Shortcomings as key optimization items. This includes both product feature iterations and the prominent display of “experience advantages” in ASO materials.

Contact AppFast Business now to receive a free professional metadata diagnosis. We’ll guide you on optimization directions across three key dimensions—keyword placement, core selling points, and copywriting logic—so your metadata better understands both algorithms and users.

Step 7: Dynamic monitoring to closely track strategic changes in competing products.

ASO competitive app analysis is not a “set-it-and-forget-it” task. Market competition is constantly evolving, and competitors’ ASO strategies are also continuously adjusted. Therefore, it is necessary to establish a normalized monitoring mechanism, with a strong focus on three dimensions:

-

Metadata Changes: Monitor whether the competing app’s app name, subtitle, keyword fields, and app description have been updated, and analyze the core purpose of these adjustments (such as seizing new keyword traffic or highlighting new features).

-

Material Optimization: Observe whether the competing products’ icons, screenshots, and promotional videos have been updated, summarize the trends in their asset optimization, and promptly follow up with corresponding adjustments.

-

Versions and Activities: Pay attention to competitors’ version update content, in-app activities, and free/Promotion strategies to determine whether they are using marketing tactics to boost their Rankings and download volumes.

It is recommended to establish biweekly competitive product analysis reports to document strategic changes in core competitors, enabling timely adjustments to your own ASO optimization strategy and ensuring you maintain a high level of market sensitivity.

Step 8: Develop offensive and defensive strategies to turn Insights into action.

After completing a comprehensive competitive analysis, the key lies in transforming intelligence into concrete tactics that provide a competitive edge. At the heart of this step is developing an integrated ASO strategy for both offense and defense—going beyond mere follow-the-leader optimization.

1. Offensive Strategy: Proactively Compete for Traffic and Users

-

Keyword ambush and surprise attack:

-

Seize the long-tail territory: For the core high-traffic keywords of competing products, a large number of long-tail keywords surrounding them are strategically deployed to draw in precise traffic from the flanks.

-

Uncover untapped traffic opportunities.: Use tools to closely monitor two key types of keyword opportunities: First, keywords for competing products that rank highly but experience frequent ranking fluctuations, indicating an unstable position; second, keywords whose search popularity shows a clear upward trend, often reflecting emerging user demand. Once these two types of opportunities are identified, concentrate optimization resources on them for a rapid blitz, which can create a chance to overtake competitors and achieve a breakthrough in Rankings.

-

Targeted optimization of metadata: In the app description and even in the copy for screenshots, provide a precise explanation centered on verified core pain points and needs of users. Also, place the keywords highlighting the product’s differentiating advantages at the forefront. This ensures that the content directly appeals to the target audience and enhances the algorithm’s ability to recognize the app’s value.

-

-

Material Conversion Battle:

-

Confronting pain points through comparison: If the analysis reveals that competitors are criticized for “too many ads” and “complex operations,” your screenshots and videos should directly and clearly convey the core selling points of “no ad interference” and “completed in three steps,” thereby capturing traffic and driving conversions.

-

Highlight differentiated value: In “Step 6: Experience in Practice,” place your unique advantages—discovered during the real-world testing—at the most prominent position in your materials, ensuring that users can immediately see the core differences between you and your competitors.

-

2. Defensive Strategies: Strengthening Barriers and Addressing Challenges

-

Core Asset Defense:

-

Brand Moat: Ensure that your brand terms and core variant terms rank first. Regularly monitor to see if any competitors are purchasing your brand terms as search advertising keywords.

-

Solidify advantageous keywords: For core industry keywords that have already achieved high Rankings, it is necessary to maintain their weight through continuous optimization and organic download growth, in order to avoid being overtaken by competitors.

-

-

Dynamic Response Mechanism:

-

Respond to major updates from competitors: When a competitor releases a major version or entirely new features, its market impact must be assessed. If it poses a threat, you should promptly reinforce your own corresponding advantageous features in ASO assets and descriptions, or respond through the release notes of a version update.

-

Identify the impact of paid promotionsAs described in “Step 5,” if a competitor’s Rankings surge in the short term due to paid promotion, there is no need to blindly adjust your core Metadata. Instead, focus on how their organic Ratings change after the promotion ends, and stick to your own long-term optimization strategy.

-

Through this step, your ASO efforts will shift from a passive “Analysis–Optimization” cycle to a proactive “Reconnaissance–Decision–Attack/Defense” competitive model, truly transforming competitor Reviews into market share.

From analysis to execution: Turning competitive insights into growth outcomes.

After completing the competitive analysis and strategy development for the above 8 steps, the most critical phase is “precise execution.” We need to break down the analysis results into specific ASO optimization actions, with the core efforts centered around three key areas:

-

Keyword optimization: Integrate the mined golden keywords into the app name, subtitle, keyword field, and app description according to the principle of “placing core keywords first and supplementing with long-tail keywords” to enhance keyword coverage and rankings.

-

Metadata Optimization: By leveraging the material advantages of competing products and aligning with user needs, optimize the app icon, screenshots, and promotional video to ensure the materials more effectively address user pain points and boost download conversion rates.

-

Product Iteration: Incorporate the needs gleaned from negative Reviews of competing products into the product’s iteration plan, fundamentally enhancing product competitiveness and providing support for ASO optimization.

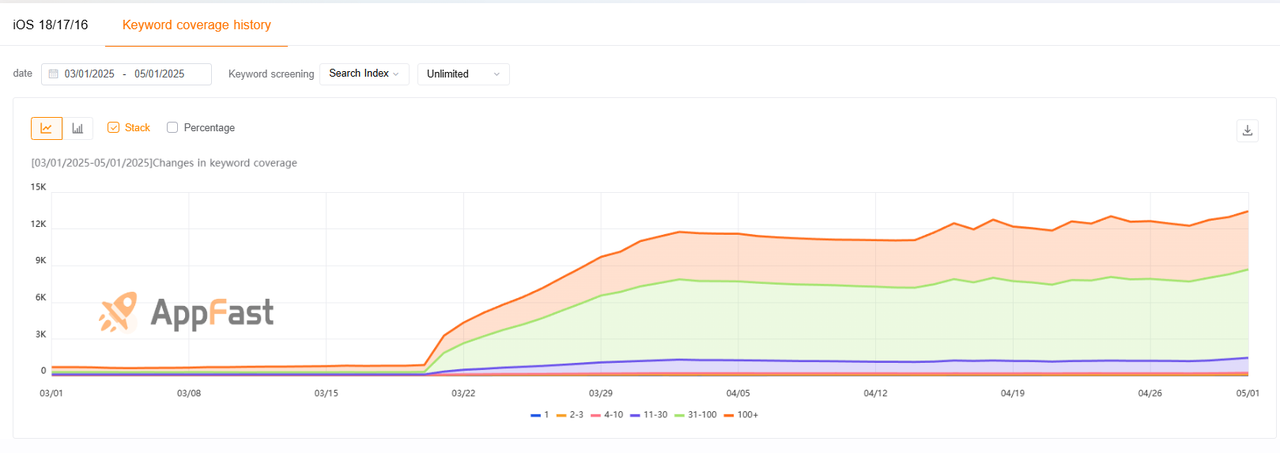

It’s important to note that ASO optimization is a “data-driven, continuously iterative” process. After optimization, you must use ASO tools to monitor data such as keyword rankings, download volumes, and conversion rates, and continuously adjust underperforming aspects to achieve long-term growth.

Want to quickly turn competitor analysis results into actionable ASO optimization plans? We offer a one-stop ASO service that coversKeyword coverage,Ranking improvementand other core stages to help your app achieve explosive growth in download numbers!

Summary

ASO Competitor Analysis it’s not about simply “copying homework”; rather, it’s a process of uncovering market patterns and identifying your own strengths through a systematic analytical approach. The eight steps shared in this article—from pinpointing true competitors to conducting dynamic monitoring—cover the entire workflow from analysis to execution. At its core, this approach ensures that your ASO optimization is no longer blind or arbitrary, but instead leverages data and market demand to deliver precise, targeted results.

In the mobile app market, only by continuously monitoring competitors and constantly optimizing your own app can you secure a foothold in the fierce competition. We hope the content of this article will help you thoroughly implement an ASO competitor optimization strategy, achieve a dual boost in keyword rankings and download volumes, and enable your app to stand out in the app stores.

Free consultation with ASO specialists

Doing ASO for the first time or have no idea how to carry out targeted optimization of your app?

We offer one-on-one customized services provided by app marketing specialists

Related recommendations

Copyright © 2018 - 2021 AppFast Company, LLC. All Rights Reserved. The AppFast word mark is a

registered trademark of AppFast Company, LLC in the US and other countries.